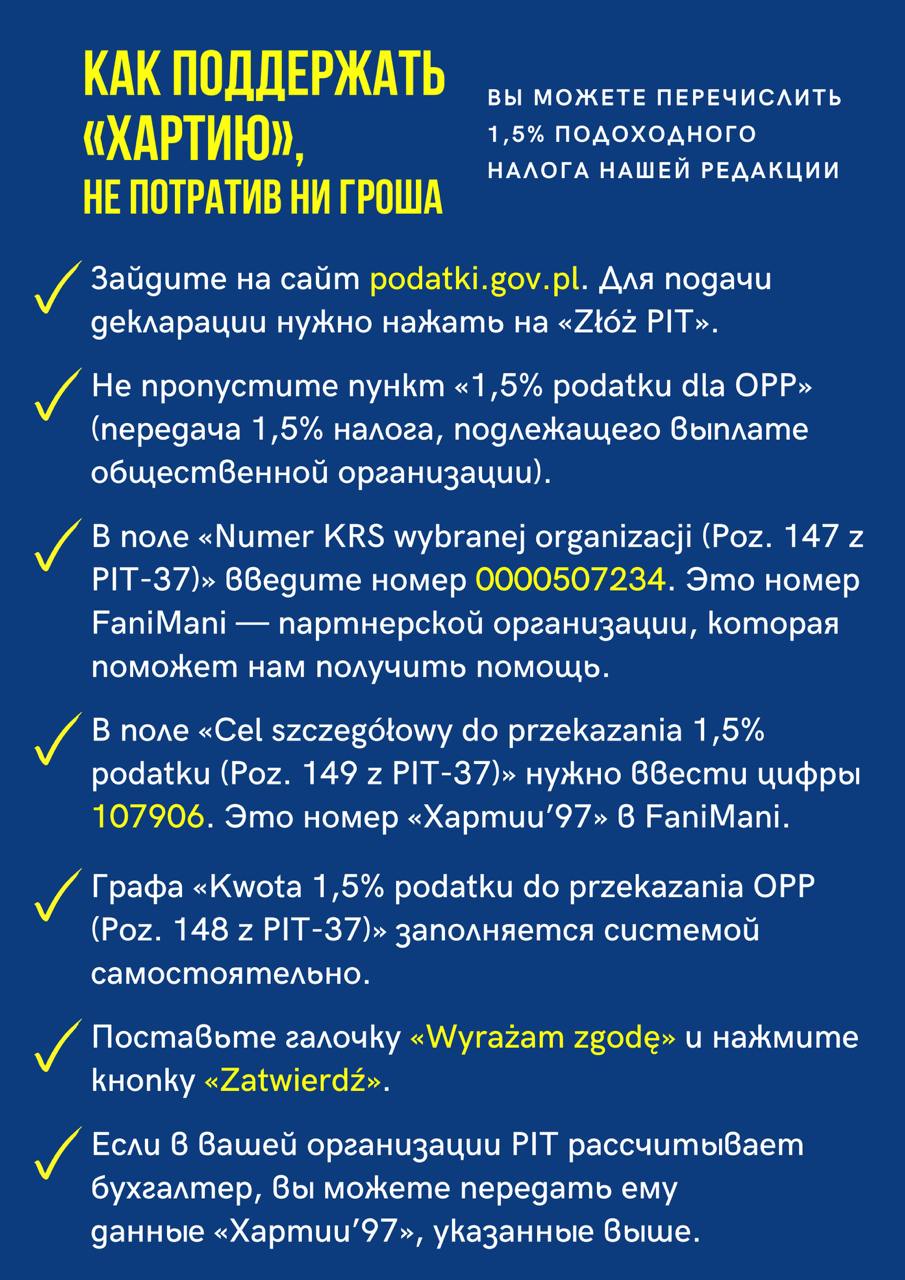

How To Support Charter Without Spending A Penny

6- 21.02.2025, 17:14

- 12,796

We need your help.

Dear friends! If you work in Poland and believe that we are doing important work, you have a simple way to support Charter’97.

The most important thing is that you will not spend a penny of your money.

You can send part of the income tax you paid to support our website by supporting the editorial team.

If you work in Poland, you need to send PIT tax returns every year — from February 15 to April 30.

To do this, go to the website podatki.gov.pl

To start filing, click on “Złóż PIT”.

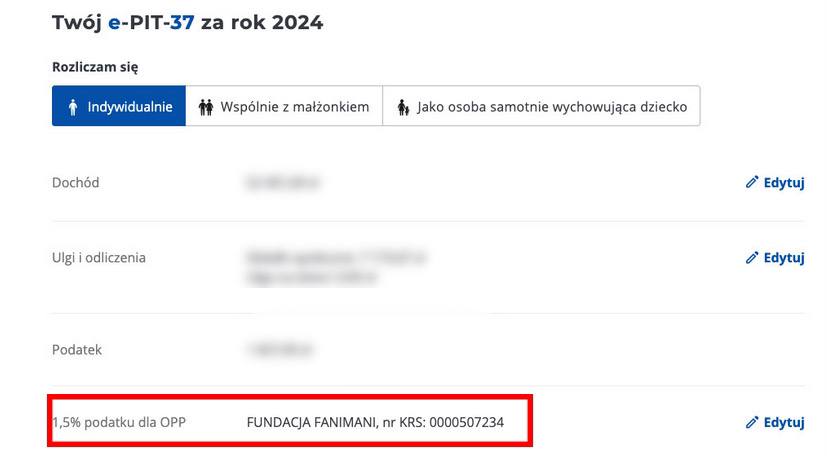

The main thing is not to miss the item “1.5% podatku dla OPP” (transfer of 1.5% of the tax payable to a public organization).

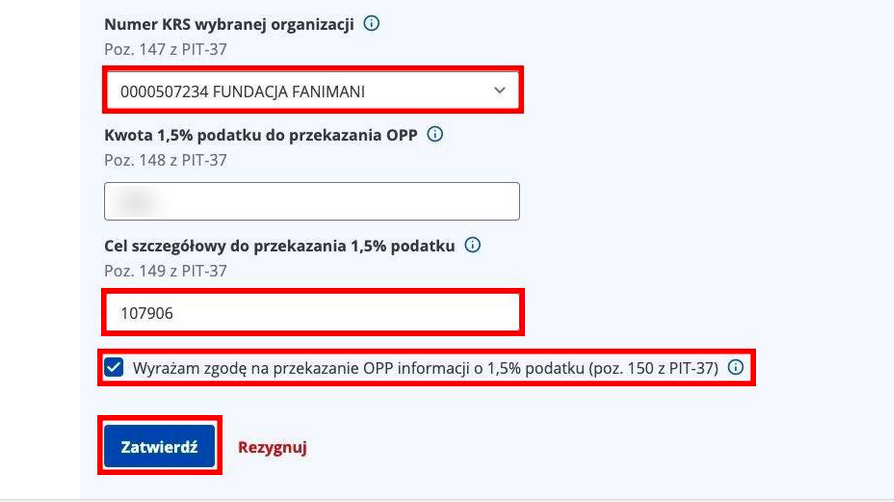

In the field “KRS number for registration of organizations (Item 147 of PIT-37)” enter the number 0000507234. This is the number of FaniMani, a partner organization that will help us get help.

In the field “Cel szczegółowy do przekazania 1.5% podatku (Item 149 of PIT-37)” you need to enter the numbers 107906. This is the number of the Charter'97 in FaniMani.

The column “Kwota 1.5% podatku do przekazania OPP (Item 148 of PIT-37)” is filled in by the system automatically.

Then check the box “Wyrażam zgodę” (consent) and click the button “Zatwierdź” (confirm).

If your organization has an accountant who calculates PIT, you can provide them with the Charter’97 data specified above.

Instructions for other types of PIT

If you are a sole proprietor (działalność gospodarcza) and are filling out another tax return, enter the data in the following fields:

Ryczałt — PIT-28

in item 251, write KRS number 0000507234;

in item 253 — 107906.

Skala podatkowa — PIT-36

in item 520, write KRS number 0000507234;

in item 522 — 107906.

Podatek liniowy — PIT-36 L

in item 172, write KRS number 0000507234;

in paragraph 174 — 107906.

If you have helped us — tell others

Today, tens of thousands of Belarusians work in Poland. After 2020, almost everyone living in Belarus has relatives, friends, acquaintances who moved to this country. You can tell them about the opportunity to support our site.

If you have already helped us — show this instruction to your friends, colleagues at work. Involve your Polish and Ukrainian acquaintances in this action.